Retirement planning is one of the most important life-stage goals! Yet, many of us are unable to plan prudently to ensure we have a comfortable and hassle-free post-retirement life. Overseas Pakistani's can now avail the benefits of planning their retirement in Pakistan through their Roshan Digital Account.

Apply Now!

The Roshan Pension Plan under VPS is a self-contributory defined contribution pension scheme open to all overseas Pakistani individuals. Under the voluntary pension scheme (VPS), all employed and self-employed individuals can voluntarily contribute to a pension fund starting with as low as PKR 10,000/- during their working life to provide regular income after retirement

Zero Sales Load

Management Fee up to 1.5%

Various investment options

Fund movement at fingertips

Customers may choose from the following allocation schemes available under the RPP.

| EQUITY SUB FUND | DEBT SUB FUND | MONEY MARKET SUB FUND | |

|---|---|---|---|

| Medium Volatility | 50% | 40% | 10% |

| Low Volatility | 25% | 60% | 15% |

| Lower Volatility | NIL | 50% | 55% |

All investments in Mutual Funds & Pension Funds are subject to market risks, Past performance is not necessarily indicative of future results. Please read the offering document to understand the investment policies, risk and tax implications involved. This is for general purpose information only.

Q1. What is Roshan Pension Plan?

Q2. Who is a Participant?

Q3. Who is the Pension Fund Manager?

Q4. Is RDA Investor eligible for investment in RPP?

Q5. What are the minimum and maximum age limits for RPP?

Q6. What are JS Pension Saving Fund and JS Islamic Pension Saving?

Q7. JS Investments Limited.

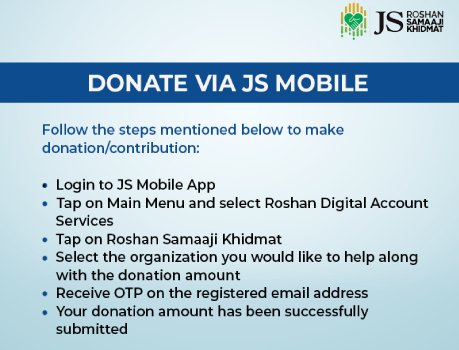

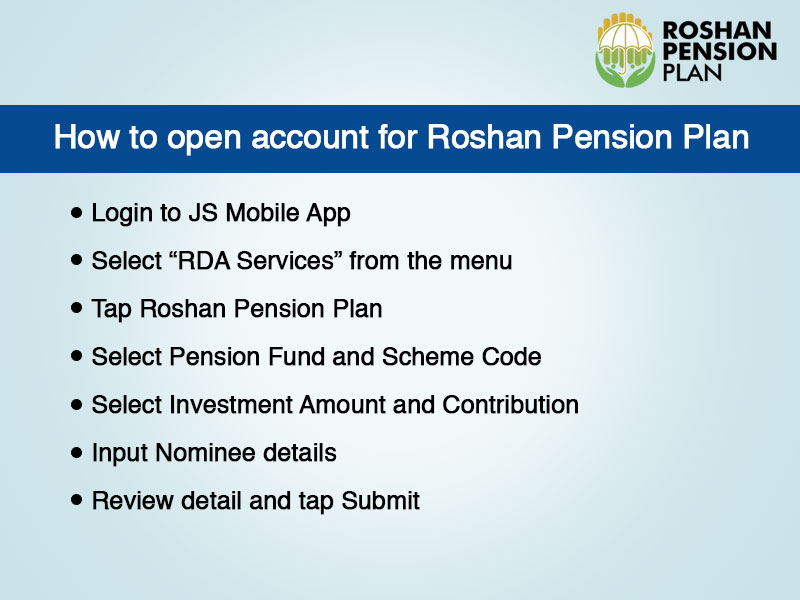

Q8. How to contribute to RPP?

Q9. What is the minimum initial amount to contribute?

Q10. How is NAV calculated?

Q11. What are the different allocation schemes in RPP?

It provides the following options to the participants to select a Pension Allocation scheme according to their requirements:

|

Without Gold

|

Equity Sub Fund

|

Debt Sub Fund

|

Money Market Sub Fund

|

|---|---|---|---|

|

Medium Volatility

|

50%

|

40%

|

10%

|

|

Low Volatility

|

25%

|

60%

|

15%

|

|

Lower Volatility

|

Nil

|

50%

|

50%

|

Q12. Can I change my allocation scheme?

Q13. In which avenues JS Investment Limited will invest the investor money?

14. What is the sales load?

Q15. What is the backend load?

Q16. What is the Management fee for RPP?

Q17. What is the rate of return on the funds?

Q18. What is the frequency of contribution?

Q19. What is the duration of profit? Monthly, quarterly or yearly?

Q20. What is the maturity period for RPP?

Q21. After maturity how will I get benefits?

Q22. What will happen if the participant dies or become disabled before the maturity period of RPP?

In case of disability before retirement:

Q23. In case of withdrawal of more than 50%, what will be the rate of tax applied?

Q24. Is it mandatory to withdraw 50% at the time of Retirement?

Q25. What happened if the participant withdraws/ redeems his/ her fund before retirement?

Q26. What allocation schemes are available for the Monthly Income Payment Plan (MIPP)?

Q27. Is there any limit on the monthly withdrawal amount from MIPP? How is the amount determined?

Q28. What if a principal participant of MIPP dies?

Q29. How Pension Funds are different from other open-end mutual funds?

Q30. Will Zakat be deducted at source under RPP?

Q31. How does one know that his/her investment is in safe hands?

Q32. Can the participant get a physical unit certificate?

Q33. How frequently will the statement of accounts be sent to the participants?

Q34. Can the participant transfer the fund to any other pension fund manager?

Q35. Can the participant change his retirement age?

Q36. Can an investor open another Pension Account after claiming retirement?

Q37. What is the benefit of Takaful in VPS?