Invest your savings in gold and enjoy the benefits of a safe and stable investment with JS MyGold. With easy monthly installments and minimum markup rates, you can buy gold biscuits and bullions and watch your cash grow in value. Facilitation for individuals to convert their savings into Gold by not only preserving but enabling the possibility of enhanced value over time.

Apply Now!

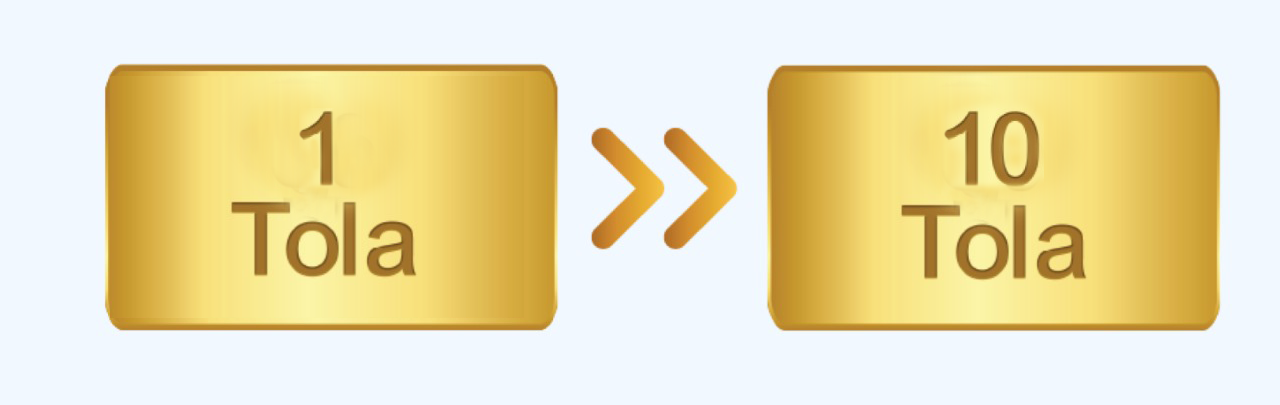

Customers can avail Gold Biscuits / Bullions based on the following weights available at the vendor(s), all of which are certified and guaranteed with 999.0% purity.

At JS Bank, we offer the best quality and pure 24k gold biscuits and bullions, sourced from trusted and reliable partners who ensure authenticity, premium quality, and 100% gold denominations under the consumer prudential regulation of the State Bank of Pakistan.

Lock your gold price today and enjoy the convenience of buying gold on easy installments with JS MyGold. Start your gold investment journey today and secure your financial future.

Get up to 10 tola

24K Pure gold

Easy monthly installments

Lock your price today

Processing Fee & Charges - As per Bank’s updated SOC

Security: Pledge of Gold Bullion being financed with Bank till repayment of finance.

Financing Amount: : Up to Rs. 5.0 Million

Financing Tenure:

Term Finance:

Individual: 1-4 years

SE (Small Enterprises): 1-5 years

Running Finance: 1-3 years

Q. What is eligibility criteria?

Q. What security / collateral needs to be provided for JS MyGold?

Q. What is the minimum income requirement for availing this facility?

Q. What is the maximum loan amount?

Q. What is the financing amount / limit offered under JS MyGold?

Q. What is Mark-up rate on JS MyGold?

Q. What is the tenor of loan?

Q. What is the processing fee for JS MyGold?

Q. Can the loan be paid before its tenor? And is there any early payment charges?

Q. What is the frequency of repayment?

Q. What is the procedure of release of security / collateral to the borrower after the loan is fully settled?

Q. Should I have an account in JS Bank to avail the service?

Q. Who should I contact if I wish to avail this financing scheme?

Q. What are the available Gold Bullion Denominations?