Karachi, August 29, 2024. JS Bank, one of the fastest-growing banks in Pakistan, announced its financial performance for the first half of 2024. The results reflect exponential growth for the Bank across key financial indicators, solidifying its position as an emerging financial institution.

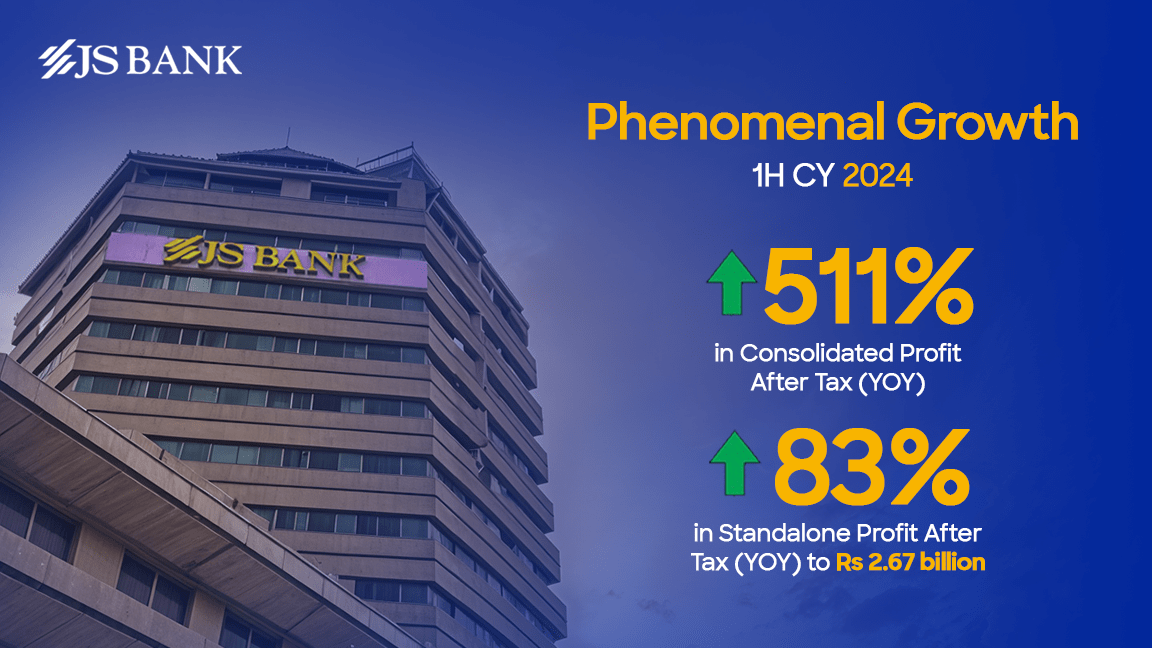

On a consolidated basis, JS Bank’s Profit Before Tax was reported at Rs. 18.79 billion, growing by 464%. In contrast, Profit After Tax was reported at Rs—9.7 billion, reflecting a growth of 511%, as compared to the same period last year. As a result, the Consolidated Earnings per share (EPS) rose to Rs. 3.87 in 1HCY24, as compared to Rs. 1.22 for the same period last year.

During the first half, JS Bank posted a standalone Profit Before Tax of Rs. 5.43 billion, growing by 69%, and Profit After Tax of Rs. 2.76 billion, recording a growth of 83%, as compared to the same period last year. The Earnings per share (EPS) also rose to Rs. 1.35 in 1HCY24, as compared to Rs. 1.16 for the same period last year.

Earlier this year, the Bank had also reached a significant milestone of crossing half a trillion in total deposits, which stemmed from a strong closing of 2023. On a consolidated basis, JS Bank closed the 1HCY24 at a level of Rs. 1.1 trillion. PACRA has also upgraded JS Bank’s rating from “AA-” to “AA” for the long term and “A1+” for the short term with a stable outlook forecast.

“We are pleased with JS Bank’s strong performance in the first half of 2024, a testament to the trust our customers place in us,” said Basir Shamsie, President & CEO of JS Bank. “Our growth is driven by our commitment to providing solutions that empower our customers to achieve greater financial independence. As we continue, our focus remains on innovation and helping our customers strengthen their overall financial well-being. We are confident in maintaining this momentum and delivering meaningful impact throughout the year.”

Committed to its role as a catalyst toward Pakistan’s prosperity, JS Bank aspires to continue its journey of impact by providing innovative conventional and digital financial solutions for customers in the years to come.