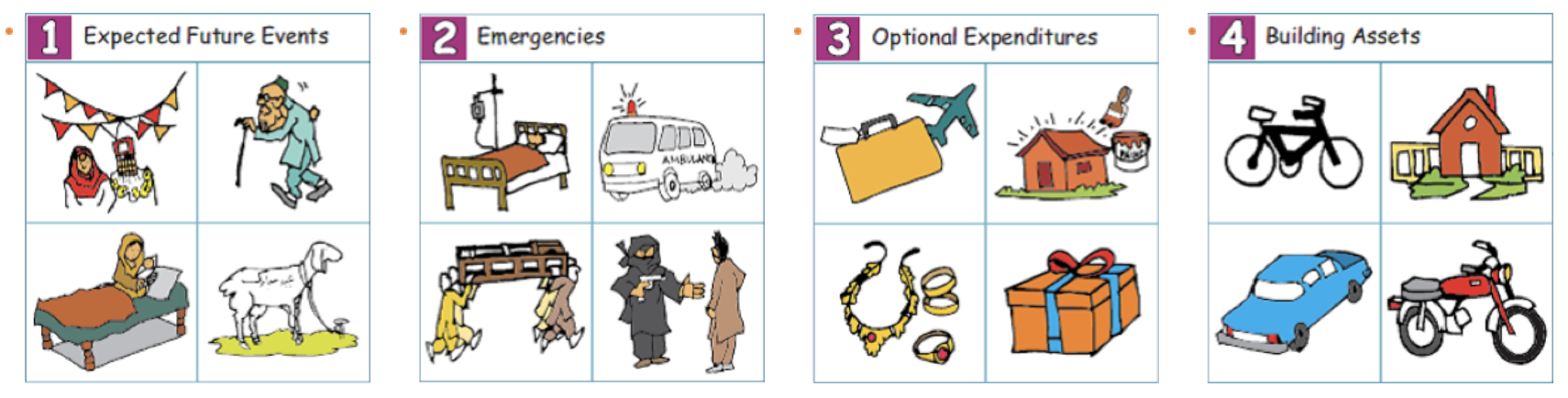

Savings play a key role in meeting financial goals. You can use savings to meet both expected and unexpected needs. In case of emergencies and crises, savings enable you to respond immediately and, over time, recover from related loss of income or property.

Click for urdu translation of this site

*Source: www.financialeducation.pk

1- Set savings goals.

2- Figure out how much you need to save over what period of time.

2- Figure out how much you need to save over what period of time.3- Decide where you will save.

4- Identify places to save, available savings products, and their pros and cons. Plan how much and how often you will save.

5- Keep track of your savings

You can choose to save through following ways:

Informal savings include saving cash at home, which keeps your cash very accessible and allows you to avoid the transaction costs associated with saving at formal savings institutions.

Disadvantages of Informal Savings:

- Temptation to spend the money

- Risk of theft

- Furthermore, money saved at home does not earn any interest, and thus may lose value over time

Saving in-kind (gold, livestock or land is another form of informal savings).

Semi-Formal savings encompass deposit collectors and group savings mechanisms, including rotating credit and savings associations (ROSCAs) called committees in Pakistan, village banks, solidarity groups and self-help groups.

The advantage of ROSCAs is that each member receives a lump sum of money at one time, with no loan or interest payments.

The disadvantages of limitations of group savings include instability of the groups, disagreements among members, members typically do not earn interest on money they have saved and limited access to funds.

Formal savings involve financial institutions, including banks, post offices, microfinance institutions, credit unions or cooperatives. Savings in these financial institutions are generally safe and earn interest. They offer a wide range of savings accounts tailored to different financial needs.

- In Regular or passbook savings, the timing and amount of deposits and withdrawals are flexible.

- Contractual savings require you to deposit a fixed amount on a regular basis over a pre-determined period of time, useful if you have a regular source of income. Access to savings often is restricted until the contract is fulfilled, and you will be charged a penalty for withdrawing your funds early.

- Time deposits require a fixed sum to be deposited for a pre-determined amount of time and interest rate. They are not accessible during this period of time, but generally yield a higher interest rate than regular or contractual savings.

Joint Account

Senior Citizens Account

Savings Account

Current Account

Time Deposit

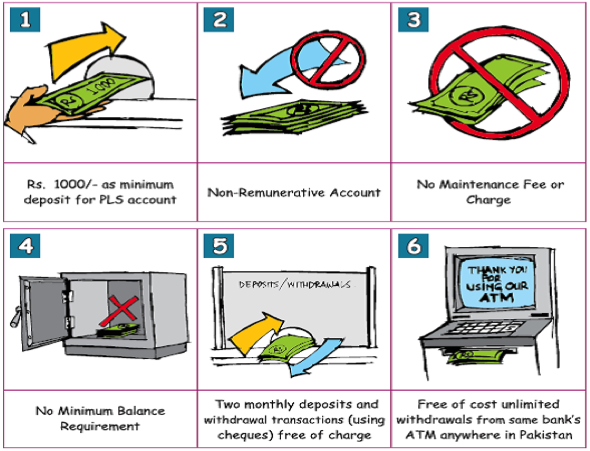

Basic Bank Account

In order to facilitate ease of banking facilities use, all commercial banks operating in Pakistan have introduced Basic Banking Accounts (BBA) facility with the following features

| DIFFICULTY | ADVICE |

|---|---|

| I barely have enough money to feed my family and pay for other basic necessities. | Start setting aside something, even if it is only a very small amount, every day or every week. The amount will grow. Look hard for ways to cut unnecessary expenses. |

| When I save, my husband always asks to use the money I have saved. | Keep money in a secure location, preferably out of the house so it is not accessible. Open a bank account. |

| My income is irregular. | Save different amounts each time you earn some income. |

| Must use all the available earnings to pay off debts. | Make a schedule to pay off the most expensive debts first. |